How to apply for CM loan scheme 2025? CM Loan Scheme 2025 is one of the initiatives launched in Punjab and other provinces to provide financial assistance to unemployed youth, small traders, students, freelancers and low-income earners. Rising unemployment, rising inflation, and limited business opportunities have put a lot of financial pressure on the common people. Therefore, this loan scheme, supported by the Government of Pakistan, aims to address this by offering interest-free loans and low-markup loans to those who want to start or expand their businesses.

If you want to know how to apply for this scheme, who is eligible, what documents you need, this detailed article covers everything in a simple and easy way.

Apply For : CM Loan Scheme 2025

Table of Contents

What Is the CM Loan Scheme 2025?

Chief Minister Loan Scheme 2025 is a government assistance program designed to make the youth of Pakistan financially independent. This initiative provides loans ranging from Rs. 50,000 to Rs. 100,000,000 depending on the applicant’s business and project category.

The core idea behind the scheme is simple:

📉 Reduce unemployment

💼 Support entrepreneurship

🏪 Boost small and medium businesses

💰 Provide interest-free and subsidized loans

🚀 Encourage youth to become financially stable

Whether you want to start any business or expand your existing business or you need financial support for skill development, CM Loan Scheme 2025 is a great opportunity.

Key Features of CM Loan Scheme 2025

| Feature | Description |

|---|---|

| ⭐ Interest-Free & Low-Markup Loans | ✔ 0% interest loans for beginners ✔ 2%–6% low markup loans for growing businesses |

| 💻 Simple & Paperless Online Application | ✔ Entire process is online ✔ Apply using only CNIC + basic documents |

| 🔍 Quick Eligibility Verification | ✔ Fast verification through: 🆔 NADRA 🏦 Bank systems 🏛 Punjab digital portals |

| 🚀 Business, Education & Freelancing Support | ✔ Start a shop ✔ Buy equipment ✔ Launch a startup ✔ Pay for freelancing courses ✔ Expand a small business |

Required Documents for CM Loan Scheme 2025

📄 To apply for this scheme, you must have the following documents:

🪪 To apply for this scheme, you must have a valid CNIC.

📱 To apply for this scheme, your mobile number should be linked to your CNIC.

📷 To apply for this scheme, you must have passport size photographs.

🏦 To apply for this scheme, you must have bank account details.

💡 To apply for this scheme, you must have a household electricity bill.

💼 To apply for this scheme, you must have proof of income.

📝 To apply for this scheme, you must have a business plan.

Also Read : What is 3000 Monthly Government Scheme 2025 – The Ultimate Guide to Pakistan’s Supportive Income Plan

Eligibility Criteria for CM Loan Scheme 2025

📋 All applicants will meet the following criteria before applying:

Basic Eligibility

🪪 To apply for this scheme, you must be a Pakistani citizen.

🆔 To apply for this scheme, you must have a valid CNIC.

🎂 To apply for this scheme, the applicant must be between 18 and 45 years of age.

💰 To apply for this scheme, the applicant must belong to a low-income family.

Specific Categories Allowed

📌 You can apply for this scheme if you:

Student

💻 You must pay to start an online business or develop skills.

Freelancer / IT Worker

🛠️ You need funding to purchase a laptop, tools, or software.

Small Business Owner

🏪 You run a workshop, shop, stall or online store.

Unemployed Youth

📈 You run any small or medium business.

Women Entrepreneurs

👩🦰 A separate quota will be created for women in this scheme.

Call to Action

⏳ If you also want to secure your future, don’t delay – prepare your documents soon and apply for CM Loan Scheme 2025 as soon as registration opens.

🚀 This is the opportunity from which you can start your own business, increase your income and achieve financial stability.

How to Apply for CM Loan Scheme 2025? (Step-by-Step Process)

📌 Here is the complete beginner-friendly application process:

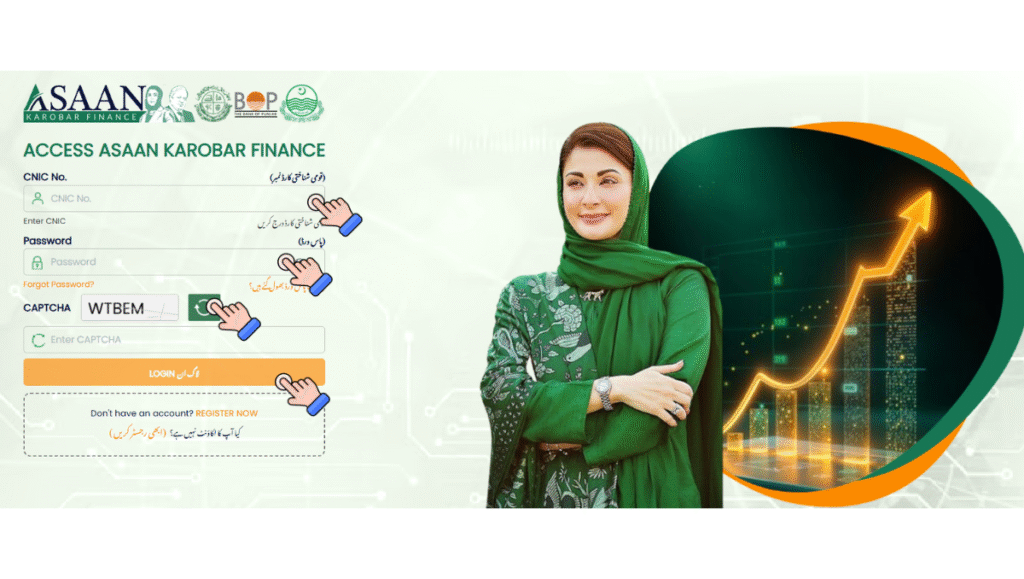

Step 1: Visit the Official Online Portal

🖥️ As soon as registration starts in the CM Loan Scheme 2025 Portal, go to the official portal of the CM Loan Scheme 2025. The website will include:

📝 Application form

✅ Eligibility checker

📄 Required documents list

Step 2: Create Your Account

👤 You will need to create an account on the website using the following:

🆔 CNIC number

📱 Mobile number

✉️ Email address (optional)

🔑 A verification OTP will be sent to your number when creating an account.

Step 3: Fill Out the Application Form

🖊️ Provide your complete and true details:

👤 Name

👨 Father’s name

🎂 Date of birth

🆔 CNIC issue/expiry

🏠 Address

💰 Income details

🎓 Education background

💼 Business details

✅ Make sure all these details are 100% correct.

Step 4: Upload Necessary Document

📷 Upload your following scanned clear concepts:

🪪 CNIC front and back

📸 Passport size photo

🏠 Proof of address

📝 Business plan

📁 The website also accepts JPG and PDF files.

Step 5: Choose Loan Type and Amount

💰 You can select one of the following:

Loan Categories

💵 Rs 50,000 – Rs 200,000 (Interest-Free)

📉 Rs 200,000 – Rs 2,000,000 (Low Markup)

📈 Rs 2,000,000 – Rs 5,000,000 (Business Expansion)

🗣️ Explain who you are borrowing from.

Step 6: Submit the Application

✅ After completing the application form:

🔍 Review your details

✔️ Confirm everything is correct

📤 Click Submit

📩 After completing the application form, you will receive a confirmation SMS.

Step 7: Eligibility Verification

🏢 Your details will be shared with the following organizations:

🆔 NADRA

🏦 Bank branch

📍 District administration

💻 Government digital systems

📱 You will be sent an SMS if additional details are required.

Step 8: Attend Interview or Verification Call

❗ Any applicant may be asked:

🏦 Visit the nearest bank

💻 Join an online interview

📝 Provide proof of business idea

⏱️ This process only takes a few minutes

Step 9: Loan Approval & Disbursement

✔️ Once approved:

📩 You will receive an SMS notification

🏦 Loan amount will be transferred to your bank account or branchless banking account

🗓️ You will receive the installment and repayment schedule

Also Read : CM Punjab Laptop Scheme Phase 2 – 5 Powerful Benefits for Students in 2025

Types of Loans Offered Under CM Loan Scheme 2025

Micro Loans (Interest-Free)

💰 Amount: Rs 50,000–200,000

📘 These loans are best for students, freelancers, beginners, and small sellers.

Small Business Loans

💵 Amount: Rs 200,000–1,000,000

📉 Low markup (2%–4%)

Medium Enterprise Loans

🏢 Amount: Up to Rs 5 million

📈 For business expansion

📊 Low markup (4%–6%)

Common Mistakes to Avoid When Applying

⚠️ To improve your approval, avoid:

🪪 To improve your approval, please correct your CNIC information.

📵 Do not use someone else’s mobile number to improve your approval.

❌ Don’t use fake business ideas to improve your approval.

🔁 Apply multiple times to improve your approval.

📷 Upload a photo of clear documents to improve your approval.

Benefits of the CM Loan Scheme 2025

| Feature | Details |

|---|---|

| ⭐ No Interest for Beginners | Helps unemployed youth start earning without financial pressure. |

| 💳 Flexible Installments | Easy repayment options so you can manage your business smoothly. |

| 🔒 Zero Collateral for Micro Loans | No security or guarantee required for small loans. |

| ⚡ Quick Approval | Fast processing through automated digital systems. |

| 👩💼 Women Empowerment | Special quota for female entrepreneurs to start their businesses. |

Final Words

If you are a student, freelancer, job seeker or have started earning from any small business or want to increase your income, then CM Loan Scheme 2025 is a golden opportunity that can fulfill your dreams. The application process for CM Loan Scheme 2025 is simple, beginner-friendly, and helps the common man a lot in growing, and it is designed for this purpose.

What is the CM Loan Scheme 2025 and how does it work?

The CM Loan Scheme 2025 is a government-supported financial assistance program designed to help unemployed youth, small business owners, freelancers, and students access affordable funding. The scheme provides interest-free loans and low-markup loans to encourage entrepreneurship and reduce unemployment.

It works by allowing eligible applicants to apply online, submit their documents, and receive financial assistance after proper verification through NADRA and bank systems. The loan amount can be used for starting a new business, expanding an existing setup, purchasing equipment, or learning high-income skills.

Who is eligible to apply for the CM Loan Scheme 2025?

Eligibility for the scheme is simple and beginner-friendly. You can apply if you:

Are a Pakistani citizen

Are between 18 and 45 years of age

Possess a valid and updated CNIC

Belong to a low or middle-income household

Have a clear business idea or plan

Are a student, freelancer, unemployed youth, or small business owner

There are also special quotas for women, people with disabilities, and residents of rural areas to ensure equal financial opportunities.

How can I apply online for the CM Loan Scheme 2025?

To apply online, visit the official CM Loan Scheme portal once registration opens. Create an account using your CNIC and mobile number, fill out the digital application form, upload required documents, and choose your desired loan category. After submitting the form, your application will undergo verification by government and banking authorities. Applicants receive SMS updates at each step. The entire process is easy, paperless, and designed for beginners.

What documents are required for the CM Loan Scheme 2025?

Applicants must prepare essential documents before applying to avoid delays. Required documents include:

CNIC (front and back)

2 passport-size photographs

Mobile number registered on CNIC

Simple business plan or idea

Home address proof (electricity or gas bill)

Bank account details (if needed)

You may also need to submit additional documents if requested during verification.

How long does it take for the loan to be approved?

The approval timeline varies depending on the applicant’s category and verification process. Generally, it takes 2 to 6 weeks for full verification and approval. If your documents and details are correct, approval is often faster. However, incomplete information or mismatched CNIC data may delay the process. Applicants are advised to regularly check SMS updates from the portal.